|

"A heavy progressive or graduated income tax."

Point

2 Communist Manifesto,

Karl Heinrich Marx

"Why do governments claim consumption

must be financed by debt?

The answer is really very simple. The wealthy

increase wealth by lending.

They use a

Ponzi scheme known as

fractional reserve banking.

When debtors cannot meet their

obligations, assets are

acquired by the wealthy at fire sale prices who then become even wealthier." -

John Kozy

"Credit

economies existed long before money and coinage.

These

economies were agricultural.

Grain was the means of

payment – paid at harvest time." - Michael Hudson

Sumerians and Babylonians

paid their beer tab at harvest time.,

, when was nice and fresh.

The

ale-woman then paid the palace or temple for the grain on the threshing floor;

an advance of wholesale beer for her to retail during the year.

Peers of Hammurabi recognized debt built to

a point it was unpayable.

Debtors unable to pay fell into bondage to

the palace or temple and, forced to work palace or temple land, ultimately lost

their own land.

In

Babylon the flight of debtors from the land drove this reality home.

Clean Slate proclamations were part of the community's

self-preservation.

Rulers recognized aid was required for people who

were sick, widows who lost their husbands or other factors that obliged them to

run up debts.

Rulers would then

cancel debt to restore

the status quo in a Jubilee

Year.

"The Greeks and the Romans learned about interest-bearing

debt from Middle Eastern

civilizations, but failed to institute Clean Slate debt amnesty.

Their failure has been an albatross around the neck of Western

economies ever since." - John Siman

"The world's biggest economies are reaching

an inflection point

where the growth in debt loads is becoming unsustainable." - William Pesek

"Debt is the source of all power and wealth

for the central banking system as

they do not actually produce any tradable good, such as industry; nor do they

provide any necessary service, such as government.

Interest on debt is

the source of income and authority for the central banking system, and thus, it

needs to continually advance credit and expand debt.

In Marxist theory,

the nature of accumulation

holds a dual character.

One is known as accumulation by expanded production, which, since

1864, has been mostly concerned with

capturing production.

Money is made through

extraction of fruits of the

production of labor.

The other nature of accumulation is

accumulation by dispossession, which is

usually framed in terms of relations

between capitalist and non-capitalist.

This is accumulation derived from

dispossessing someone of something.

The

Atlantic slave trade was an example of

accumulation by dispossession, as Africans

were dispossessed of their lives and freedom.

Colonialist resource extraction

dispossess' a nation of it's resources.

Perhaps it

would be helpful to expand upon Marx's ideas of

accumulation by

dispossession in regards to the central banking system.

Central

banking represents an example of accumulation by dispossession.

Money, loaned at interest which debtors are

never able to fully repay, dispossesses them of freedom

through interest payments and

debt bondage.

Debt is just another word for slavery,

therefore, the central banking

system itself, functions through a system of accumulation by dispossession.

Conventional understanding of

accumulation by

dispossession describes it as

an interaction between

capitalist and non-capitalist modes of production; the

capitalist mode will

dispossess the non-capitalist mode of

production.

Central banking,

the pinnacle of the

capitalist system and the primary

source and avenue of its

power, is an interaction between

central banks and ALL modes of

production including those of

ALL the ecosystems of

Earth.

Industry/commerce, governments/nations, and

individuals/people, are ALL dispossessed of freedom

through debt bondage." - Andrew

Gavin Marshall

Fannie Mae, Freddie Mac and Sallie Mae

1938 Fannie Mae, the

Federal National Mortgage Association, is founded as a government agency

as part of Franklin Delano Roosevelt's

New Deal (an extension of Herbert Hoover's New Deal),

in order to provide liquidity to the mortgage

market.

1938 to 1968 Secondary mortgage

market in the US is monopolized by Fannie Mae.

1968 Fannie Mae is converted into

a private corporation to help balance the federal budget.

Fannie Mae at

one time is the ninth-largest business in the world according to

Forbes.

The Government National Mortgage Association, Ginnie Mae, is

established to promote home ownership.

1970 Emergency Home Finance Act is passed

to provide competition in the

secondary mortgage market, and to prevent Fannie Mae from continuing to

have a monopoly.

Congress

charters Freddie Mac as a

private corporation to compete in this same market.

Ginnie Mae begins

creating and guaranting mortgage-backed securities.

Most mortgages

securitized as Ginnie Mae mortgage-backed securities (MBSs) are insured by the

Federal Housing Administration (FHA), which typically insures mortgages to

first-time home buyers and low-income borrowers.

1972 Sallie Mae, the Student Loan

Marketing Association is founded as a government sponsored enterprise.

The coorporation remains the country's largest originator of federally

insured student loans.

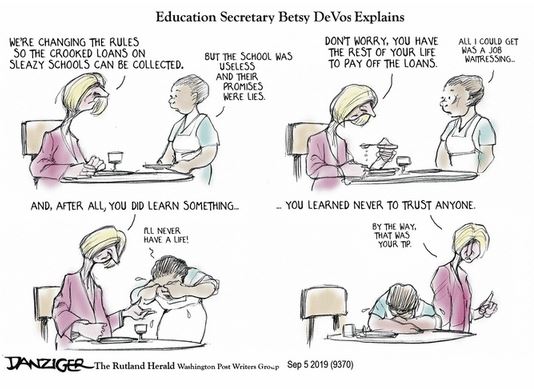

"The dirty little secret of the guaranteed

student loan market is how concentrated it is: only 32 lenders hold 90% of the

loan volume.

The Education Department has found that at about 300

colleges one lender controls 99% of loan volume -

essentially holding a monopoly on those

campuses" - Stephen Burd

1989 Under the

Financial Institutions Reform, Recovery, and Enforcement Act

Freddie Mac becomes a publically

traded entity.

1996

Lenders of student loans are specifically exempted from the Fair Debt

Collection Practices Act.

1999 The statues of

limitations are removed from license debt

created from student loans.

Student loans are now never forgiven

in bankruptcy.

Student seeking loans are not allowed to shop loans;

captive lenders.

Student loans may be refinanced only once,

if interest rates drop the borrower will

be stuck with the original rate without an

interest rate swap.

Defaults are typically charged 25% of the loan value.

Student

loans are also exempt from "truth in lending" regulations and rules that

require lenders to explain fees and interest rates.

Student loan

collection rights include the right to garnish

wages,

tax refunds, Social

Security payments and disability payments.

2000 Sallie Mae

starts its Opportunity Loan Program.

A lender hands a college a

fixed amount of private loan money which the college then lends to students

with credit problems for higher rates with less consumer protection.

The college then promises to make the lender it's exclusive provider of

loans backed by Sallie Mae.

This is

monopolizing a captured

market through kickbacks.

Sallie Mae denies

wrongdoing

but agrees to pay a $2 million fine.

2005 Freddie

Mac hires the lobbying and PR firm DCI Group for a "stealth lobbying

campaign."

DCI did not file lobbying reports on the contract;

Freddie Mac executives

referred to the lobbying campaign as their "stealth lobbying campaign."

2006 Hank Paulson nationalizes Fannie Mae and

Freddie

Mac.

Fannie Mae pays a fine of $400 million for alleged accounting

manipulations and lying to investors. Earnings are reduced by $6.3

billion.

Freddie Mac is fined $3.8 million for illegal campaign

contributions arranged by Freddie Mac lobbyists including former House Speaker

Newt Gingrich, who recieved $300,000 to push for increased

deregulation, and former Senator Alfonse

D'Amato.

Freddie Mac agrees to settle lawsuits stemming from a $5

billion profit reduction restatement of 2003 earnings.

Freddie Mac makes

"six-figure payments to 52 outside lobbying firms and political

consultants."

After nationalization, Fannie and Freddie own 90% of US

housing loans.

2007

Private equity group led by JC

Flowers that has sought to buy out Sallie Mae informs Sallie Mae that if

reductions in subsidies

pending in a legislative bill are passed by Congress then the sale would be at

risk.

George Walker Bush requested a reduction of

subsidies to Sallie Mae of $16 billion.

The House approved of a measure that would lower subsidies by $19

billion over five years.

No

subsidies = no deal.

September 6, 2008 The director of the

Federal Housing Finance Agency (FHFA), James B. Lockhart III announces

his decision to take Fannie Mae and Freddie Mac into conservatorship run by

FHFA.

Over 98% of Fannie's loans were paying timely but $270 billion in

loans that Fannie Mae had purchased or guaranteed between 2005 and 2008 were

now considered risky.

Fannie Mae and Freddie Mac each had a positive net

worth as of the date of the takeover.

The takeover was triggered by

credit default swap derivative

contracts.

In credit default swap

parlance this is termed a 'credit event'.

It triggers the settling of

outstanding contracts for the derivatives,

which are used to hedge or speculate on the

potential risk that a incorporation will default on its

bonds.

"Credit

default swaps are essentially insurance policies covering the losses on

securities in the event of a default.

Financial institutions buy them

to protect themselves if assets drop in

value.

It's like bookies

trading bets, with banks and hedge funds gambling on whether an investment

(bundled subprime mortgages) will succeed or fail.

Swap related provisions of Gramm's bill - supported by Fed

chairman Alan

Greenspan and Treasury

secretary Larry Summers - a $62 trillion

market (nearly four times the size of the entire US stock market) remained

utterly unregulated, no one made sure the banks and hedge funds had the assets

to cover the losses they guaranteed." - David Corn

Fannie Mae and

Freddie Mac had approximately $ 1.5 trillion in bonds outstanding, and since

the market in credit default swaps is not

public, there is no central reporting

mechanism to verify how many credit default swaps are linked to those

bonds.

Fannie Mae unveils the HomeSaver

Advance plan to provide "foreclosure prevention assistance to

distressed borrowers" to avoid increased losses of as much as $2.4 billion

in credit default swaps.

About

71,000 cash advances to forestall foreclosure with an average value of

$6,500 for a total of $462 million.

In spring 2009 Fannie Mae valued

those loans at $8 million.

"Whatever credit defaults

are in theory, in practice they are mainly side bets on whether some

incorporation, or some subprime

mortgage backed bond, some municipality, or even the US government will go

bust.

Call it insurance if you like, but it's not the insurance most

people know.

It's more like buying fire insurance on your neighbor's

house, possibly for many times the value of that house - from a incorporation

that probably doesn't have any real ability to pay you if someone sets fire to

the whole neighborhood." - Michael Lewis & David Einhorn 01/03/08

"On September 7, 2008, the Federal Housing Finance Agency

(FHFA) placed Fannie Mae and Freddie Mac, two government-sponsored enterprises

(GSEs) that play a critical role in the US home mortgage market, in

conservatorship.

As conservator, the FHFA has full powers to control the

assets and operations of the firms.

This means that the

US taxpayer now stands behind

about $5 trillion of GSE-issued debt." - Mark Jickling, November 24, 2008

"When Fannie Mae and Freddie Mac were taken into conservatorship, they

were leveraged at an eye-popping

100 to 1." - Mike Whitney

Franklin Raines, Bill

Clinton's White House

budget director, is accused

by the Office of Federal Housing Enterprise Oversight (OFHEO), the

regulating body of Fannie Mae, of abetting widespread accounting errors based

on the overstated earnings estimated at $6.3 billion.

The OFHEO

announced a suit against Franklin Raines in order to recover some or all of the

$50 million in payments made to Franklin Raines.

Fannie Mae chief

Franklin Raines, chief financial officer Timothy Howard and former controller

Leanne Spencer agree to a $31.4 million

settlement.

2009

David Kellermann, CFO of Freddie Mac, commits

suicide.

Freddie Mac

asks for $31 billion in additional aid after posting a gargantuan loss of more

than $50 billion in 2008.

The loss' were driven by $13.2 billion in

hedged trades, $7.2 billion in credit losses from the declining housing market

conditions and $7.5 billion in write-downs of the value of its

mortgage backed securities.

The

incorporation also takes a charge of $8.3 billion for now-worthless tax

credits.

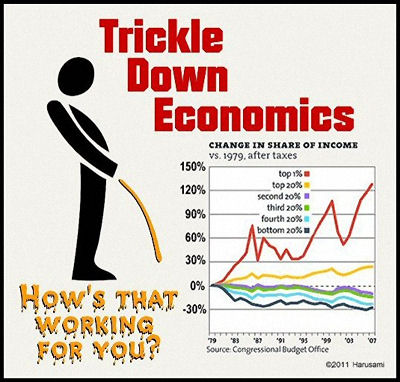

"Madison Avenue helped drive the expansion with use of credit

cards.

There was a lot of money to be made by collecting fees for loan

origination and debt service, and the largest banks wanted in on the action.

The 1980s was the age of

a paradigm shift

in American politics.

The US was transformed as the profit

motive supplanted the public good.

The rich were taking it all for

themselves and letting the good times roll and everyone who wasn't rich wanted

to be or act as if they were rich.

Advertisers suggested people could

purchase the 10-day Caribbean cruise or expensive diamond ring that was once

restricted to those with higher income levels creating

the illusion that debt was equal to

wealth." - Paul C. Wright

"In times past,

bankruptcy would have wiped out the bad

debts.

The problem with debt write-offs is the very wealthy hold

most of the savings, so the government doesn't want to have them take a loss.

It would rather wipe out pensioners,

consumers, workers,

industrial companies and foreign investors.

So toxic debt will be kept

on the books and the economy will slowly be strangled by debt deflation." - Michael Hudson 06/08

|

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to discern

pr☠paganda from reality and that this has been done purposefully by an

internati☣nal c☣rp☣rate cartel through their agents who wish

to foist a corrupt Ѵersion of Яeality on the human race.

Religi☯us int☯lerance ☯ccurs when any group refuses to

tolerate religi☯us practices, religi☸us beliefs or persons due to

their philosophical ideology. This web site marks the founding of a system of

philºsºphy nªmed the Mŷsterŷ of the Lumière

Infinie - a ra☨ional gnos☨ic mys☨ery re☦igion based on

reaso🐍 which requires no leap of faith, accepts no tithes, has no

supreme leader, no church buildings and in which each and every individual is

encouraged to develop a pers∞nal relati∞n with Æ∞n

through the pursuit of the knowλedge of reaλity in the cu☮ing

the spi☮itual co☮☮uption that has enveloped the human spirit.

The tenets of the Mŷsterŷ of the Lumière Infinie are spelled

out in detail on this web site by the author. Vi☬lent acts against

individuals due to their religi☸us beliefs in America is considered a

"hate ¢rime."

This web site in no way c☬nd☬nes

vi☬lence. To the contrary the intent here is to reduce the vi☬lence

that is already occurring due to the internati☣nal c☣rp☣rate

cartels desire to c✡ntr✡l the human race. The internati☣nal

c☣rp☣rate cartel already controls the world central banking system,

c☸rp☸rate media w☸rldwide, the global indus✈rial

mili✈ary en✈er✈ainmen✈ complex and is responsible for

the coλλapse of moraλs, the eg● w●rship and the

destruction of gl☭bal ec☭systems. Civilization is based on

coöperation. Coöperation with bi☣hazards of a

gun.

American social mores and values have declined precipitously over

the last century as the internati☣nal c☣rp☣rate cartel has

garnered more and more power. This power rests in the ability to deceive the

p☠pulace in general through c✡rp✡rate media by

press☟ng em☠ti☠nal butt☠ns which have been

πreπrogrammed into the πoπulation through prior

c✡rp✡rate media psychological operations. The results have been

the destruction of the fami♙y and the destruction of s☠cial

structures that do not adhere to the corrupt internati☭nal elites vision

of a perfect world. Through distra¢tion and ¢oer¢ion the

direction of th✡ught of the bulk of the p☠pulati☠n has been

directed toward solutions proposed by the corrupt internati☭nal elite

that further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion and

☨hough☨s have been adapted, edited, corrected, redacted, combined,

added to, re-edited and re-corrected as nearly all opinion and

☨hough☨ has been throughout time but has been done so in the spirit

of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|