|

"When you are dealing with a world chain of financial consulates, all

linking up in a world system, none of them regarded as

American banks,

or British banks, or

French banks, or

Italian banks, or

German banks, but all of them

members of the World Banking System, you are obviously not dealing with

individuals who are trying to make a living." -

Henry Ford

1930

Bank for

International Settlements (BIS) is established by

Charles G. Dawes (Vice

President under Calvin

Coolidge from 1925-1929), Owen D. Young (founder of

RCA and Chairman of

General Electric from 1922 until 1939), and

Hjalmar Schacht of

Germany (President of the Reichsbank).

The BIS is the "international

central bank for the central bankers."

"The

international bankers

swept statesmen, politicians, journalists and jurists all to one side and

issued their orders with the imperiousness of absolute monarchs." - Lloyd

George, British Prime Minister

The International Monetary Fund and the

World Bank deal with governments. The BIS deals only with other central banks.

The BIS is a closed corporation owned by the 55 central banks.

Major shareholders include the Federal Reserve,

Bank of England, Bank of Italy, Bank of

Canada, Swiss National Bank, Nederlandsche Bank, Bundesbank and Bank of

France.

The heads of these central banks travel to the Basel

headquarters once every two months, and the General Meeting, the BIS's supreme

executive body, takes place once a year.

The Basel headquarters are

listening device proof.

There are no public minutes of the meetings.

Everything discussed is confidential.

"Central bankers can

sometimes be prima donnas." - BIS SG Gunter Baer

"BIS promotes

monopoly capitalist fascism." -

Dean Henderson

Central bankers wield power that exceeds that of many

political leaders.

Their decisions affect entire economies.

Central bankers set interest

rates determining the cost of borrowing, the

overall money supply and

the speed of global financial

currents.

Central bankers are in charge of bank supervision in most

countries.

1932 "We

have in this country one of

the most corrupt institutions in the world.

I refer to the

Federal Reserve Board.

This evil

institution has impoverished and

bankrupt the US.

It has done this through the corrupt practices of

the moneyed vultures." -

Louis T. McFadden, chairman House Banking &

Currency

"Zionist financial

power dominates the entire world in its material affairs.

Concentrated Zionist power is

working in unison

to destroy the existing order of

things." - Arthur Nelson Field, The Truth About the

Slump

1934 "A warehouseman, taking goods

deposited with him and devoting them to his own profit, either by use or by

loan to another, is guilty of a tort,

a conversion of goods for which

he is liable in civil, if not in criminal, law.

By a casuistry which is

now elevated into an economic principle, but which has no defenders outside the

realm of banking, a warehouseman who deals in money is subject to a diviner

law: the banker is free to use for his private interest and profit the money

left in trust. . . . He may even go further.

He may create

fictitious deposits on his

books, which shall rank equally and ratably with

actual deposits in any

division of assets in case of

liquidation." - Elgin Groseclose, Institute for International Monetary

Research

The BIS, a corporation, has

the status of a sovereign power and is immune from all governmental control.

A summary of this

immunity bath is

listed below:

1) Diplomatic immunity for persons and what they carry

with them (i.e., diplomatic pouches).

2) No taxation on any

transactions, including

salaries paid to

employees.

3) Embassy-type immunity for all buildings and/or offices

operated by the BIS worldwide.

4) No oversight of operations by any

government authority, never audited.

5)

Freedom from immigration

restrictions.

6) Freedom to encrypt any and all communications of

any sort.

7) Freedom from any legal

jurisdiction, they have their own police force.

The first President

of BIS is Rockefeller banker Gates McGarrah - an official at

Chase Manhattan and the Federal Reserve.

McGarrah is the grandfather of

former CIA director

Richard Helms.

Gates

McGarrah, a director of the Astor Foundation and chairman of the New York

Federal Reserve, was a member of the Pilgrims Society.

Historian Carroll

Quigley says BIS was part of a plan, "to create a world system of financial

control in private hands able to dominate the political system of each country

and the economy of the world in

a feudalistic fashion

by the central banks acting in

concert by secret agreements."

1933 "Practices of the

unscrupulous money changers stand indicted in

the court of public

opinion, rejected by the

hearts and minds of men. The money

changers have fled from their high seats in the temple of our

civilization." - Franklin D

Roosevelt inaugural address

1934 New

Britain magazine of London publishes a statement made by former

British Prime Minister David

Lloyd George that, "Britain is the

slave of an international

financial bloc."

1944 US lobbys unsuccessfully for

BIS demise at the post-WWII Bretton Woods

Conference.

The IMF and the World Bank are forged at

Bretton Woods Conference.

BIS

holds at least 10% of monetary reserves for at least 80 of the world's central

banks, the IMF and other

multilateral institutions.

The

financial underwriter for

international agreements monitors the global economy and serves as lender

of last resort in global

financial collapse.

The IMF and World Bank are central to this "New World Order".

World Bank bonds are floated by

Morgan Stanley and

First Boston.

The French Lazard family becomes involved in

Morgan interests.

Lazard

Freres - France's investment bank - owned by Lazard and David-Weill

families - old Genoese banking scions represented by Michelle Davive.

A

major shareholder, Chairman and CEO of Citigroup was Sanford

Weill.

In planning the

post-war economy it is jointly decided that the Black Eagle Trust will be used to fight

communism,

bribe political leaders, enhance

the treasuries of US allies, and

manipulate elections in

foreign countries.

This trust is headed by

Secretary of War Henry

Stimson, assisted by John J. McCloy (next head of the World Bank) and

Robert Lovett (next Secretary of Defense) and consultant Robert B. Anderson

(next Treasury Secretary).

Robert B. Anderson, operator of Commercial Exchange Bank of

Anguilla in the British West Indies is convicted of running

illegal offshore

banking operations and tax

evasion. Investors lose about $4.4 million.

"The Firm participated

actively in the postwar development of the international capital market in the

United States and in the new so-called Eurobond market that emerged in the

1960s.

As the Firm has expanded, the scope and nature of its practice

has afforded S&C the opportunity to retain lawyers in locations more

convenient to our clients.

S&C opened new U.S. branches in

Washington, D.C. (1977), Los Angeles (1984) and Palo Alto (2000).

The

Firm reopened its Paris office (which had been closed during World War II) in

1962, and opened new offices in London (1972), Melbourne (1983), Tokyo (1987),

Hong Kong (1992), Frankfurt (1995), Beijing (1999), Sydney (2001) and Brussels

(2017). " - Sullivan & Cromwell

LLP

1950 US corporations pay

26% of the total US tax bill.

1963 Eurodollar market is worth

around $148 million.

1966 " The powers of

financial capitalism had a far reaching plan, nothing less than to create

a world system of financial

control in private hands.

This system was to be controlled by a

world central bank acting in concert through secret agreements arrived at in

frequent meetings and conferences.

The apex of the system is the Bank

For International Settlements - a private bank owned by state central banks,

themselves private

corporations.

Each central bank dominates the state by control over

treasury loans, by manipulating

foreign exchanges, to influence the

level of economic activity in the country, and

to influence cooperative

politicians by subsequent economic rewards in the business world."- Carroll

Quigley Tragedy And Hope

1968 Guaranty Trust launched

Euro-Clear, a Brussels-based automated bank clearing system for Eurodollar

securities.

Some took to calling

Euro-Clear "The Beast".

Brussels serves as headquarters for

NATO and the

European central bank.

1973 Morgan

officials meet secretly in Bermuda to plan

the repeal the Glass Steagal Act.

Morgan and the Rockefeller provide financial backing for Merrill Lynch

boosting it into the Big 5 of US

investment banking.

1981

Eurodollar futures contract open

1990 US corporations now pay 9% of the total US

tax bill.

1982 Eurodollar market is

worth $2 trillion, while the M-1 US money supply stood at $442

billion.

Utilization of Eurodollar offshore bank accounts by the

super-rich costs cash-strapped governments globally trillions of dollars in

annual revenue.

1994

US Federal Reserve buys shares in BIS.

"Under a misguided

set of international rules that took hold toward the end of the 1990s,

banks were allowed to use internal risk measurements to set capital

requirements." - Joe Nocera

Mark-to-market or

fair market value accounting

refers to inflating asset values to assume predicted market return at time of

future sale.

This is an unrealistic valuing strategy as true fair market

value can only be known for certain at the point the exchange contract is

executed.

Fair value accounting becomes a part of Generally Accepted Accounting

Principles (GAAP) in the US.

Enron used the

concept of

fair market value to inflate the

future value of electricity transmission held by off-balance-sheet "special

purpose" entities as futures

contracts which lead to the collapse of the

Enron energy futures

exchange.

Failure to employee mark-to-market is given by

Wall Street as the mitigating cause

of the

Orange County Bankruptcy (OCB).

"The more

complicated these investments are, the more a question of appropriateness comes

to the fore." - Felix Rohatyn, Lazard Freres partner and former chairman of the

Municipal Assistance Corporation.

The largest

investment bank to deal with Orange

County was Merrill

Lynch.

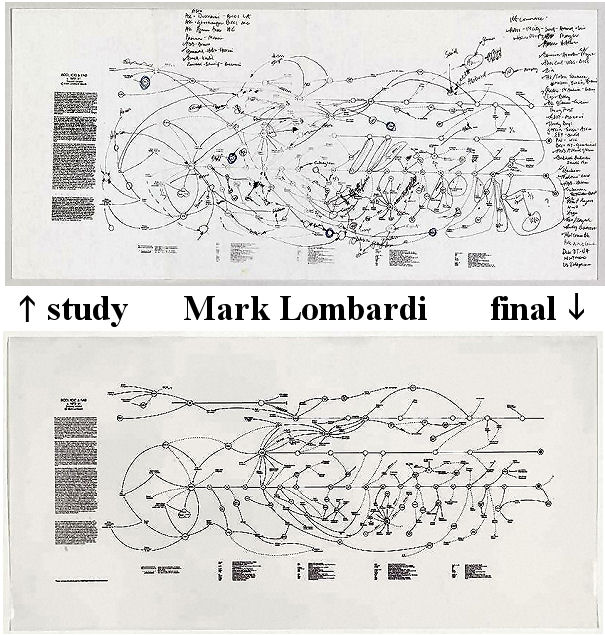

"It is difficult to avoid the

observation that Lombardi's drawings make visible: that since the 1970s,

criminals have warped the world banking system to their own bent.

RT

Naylor's prediction of the "mass criminalization of the financial business" and

the worst fears of Interpol chief Raymond Kendall have both come to

pass.

The BIS informed the author that "derivatives embedded in loans,

securities, and other on-balance sheet

assets (e.g. credit-linked notes) do not fall within the scope of our OTC

derivatives statistics and are therefore not reported to us unless they are a

derivative instrument that must be treated separately under FAS 133 or IAS 39.

This means that the $835 trillion in outstanding derivatives positions

reported to the BIS in June 2012 did not include the subprime mortgages market,

which De Soto estimated in excess of $500 trillion in 2009.

It is

reasonable to infer that at least one reason why the Federal Reserve has tried

to keep interest rates so low for so long is to avoid upsetting the derivatives

markets and the related hedge books of banks and other corporations." -

Patricia Goldstone

2008

Off-balance-sheet

assets, much of it securitized credit-card debt at just the four biggest US

banks - Bank of America,

Citigroup,

JP Morgan Chase and

Wells Fargo - is about $5.2 trillion,

according to annual filings.

"Asset

price inflation fueled by the Federal Reserve – is giving way to debt

deflation.

We have reached a limit in which scheduled interest and

amortization absorb the entire economic surplus.

New construction,

investment and employment are grinding to a halt.

Families and

real estate investors are using their

entire disposable income to pay creditors or face bankruptcy." - Michael Hudson

06/08

Chronic Illness and Bankruptcy

#1 Reason Americans File for Bankruptcy

March 23, 2009 Treasury Secretary Timothy Franz

Geithner, a protégé of

Henry Kissinger,

announces his latest plan which seeks to harness government and private

resources to purchase an initial half-trillion dollars of off-balance-sheet

toxic debt of investment banks.

Timothy Franz Geithner holds out the

expectation that the program will eventually could grow to $1 trillion.

"Here's the scenario:

The borrower is a retailer that has been

in business for 26 years.

They have five retail outlets, employ 90

people, have revenue of over $10 million and are

well-respected members

of their community.

In 2007, its bank approved a term loan to

expand the business.

The term loan balance is $650,000.

They

also have a $1 million working capital line of credit for inventory and they

owe $800,000.

The loan is supported by the personal guarantees of the

two business owners and UCC filings on the incorporation assets, which is

basically inventory.

The last three years, financial statements reflect

a decrease in revenue (sales) and they have sustained losses.

When the

bank made the term loan, the business's

financial statements already reflected losses.

Nonetheless, the bank wrote

covenants into their loan

agreement that required the business to produce a certain level of

profitability.

If the business did not meet this level of

profitability, the loan could be called for

"technical default" of the covenant.

From day one, the bank waived this requirement.

That is, until

this year, when they placed the loan in their "special assets/workout division"

and subsequently "called" the

loan.

The bank demanded payment in full by April 1.

It is

important to understand that this businmess never missed even one payment on

either loan.

The owners were working diligently to reduce expenses.

They hired seasoned retail consultants to guide them through the

process of restructuring their business so that they would be able to remain in

business.

The owners showed every willingness to work with the bank and

make the changes that would bring them through this

economic crisis with all commitments

met as agreed.

The owners were faced with the realization that the bank

was going to close them down.

Their new loan officers,

the decision

makers, were in another state and communicated with them through e-mail.

Let's examine the stupidity and short-sightedness of this bank's

decision.

If the bank demands payment in full on the loan, they put the

company out of business.

The bank will then sell the inventory and

perhaps get 50 cents on the dollar for the inventory.

The bank will

still sustain a loss of $750,000.

Additionally, the 90

employees will now

be out of work.

And five pieces of commercial property would become

vacant and no longer produce cash flow (rent) to the landlords.

If the

landlords cannot fill the space, and don't have the rental income, it is likely

that they will not be able to make their mortgage payments on the commercial

properties.

The domino

effect is astounding." - Joe Nocera March 10,

2009

April 24,

2009 Nonperforming

on-balance-sheet assets of JP Morgan Chase grew 185% over

the past year to $14.7 billion.

Bad assets of

Bank of America

increase 229% to $25.7 billion.

Bank of America hammered with foreclosure fraud

lawsuits

Problem assets at Citigroup rose 128% to $27.4 billion, and

Wells Fargo jumped 180% to

$12.6 billion.

2009

Bank of America,

General Electric and

ExxonMobil pay no US federal

taxes.

Exxon's net

profit for that year is over $45 billion.

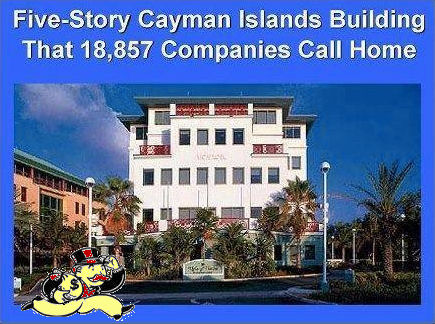

"Exxon utilized

subsidiaries in the British Crown-controlled Bahamas, Bermuda and Cayman

Islands to dodge the IRS.

These opaque offshore Eurodollar markets also

launder Saudi

petrodollars, CIA drug money

and Mossad arms

profits.

Illicit funds

come out squeaky clean on the balance sheets of mega-banks.

Secretive Swiss banks play a key role." - Dean Henderson

2011 Rudolf M. Elmer, former head of the Cayman

Islands office of the prominent Swiss bank Julius Baer, announces he has handed

over to Wikileaks information on 2,000 prominent individuals and companies that

he says engaged in tax

evasion and other criminal activity.

Elmer described those exposed

as "pillars of society".

At one point in time the BIS' board of directors, five elected - the

rest permanent, were:

# Nout H E M Wellink, Amsterdam (Chairman of the

Board of Directors)

# Hans Tietmeyer, Frankfurt am Main (Vice-Chairman)

# Axel Weber, Frankfurt am Main

# Vincenzo Desario, Rome

# Antonio

Fazio, Rome

# David Dodge, Ottawa

# Toshihiko Fukui, Tokyo

#

Timothy Franz Geithner, New York

# Alan Greenspan,

Washington

# Lord George, London

# Hervé Hannoun, Paris

#

Christian Noyer, Paris

# Lars Heikensten, Stockholm

# Mervyn King,

London

# Guy Quaden, Brussels

# Jean-Pierre Roth, Zürich

#

Alfons Vicomte Verplaetse, Brussels

2015

Scapegoat Economics 2015

2019

The BIS estimates interest rate derivatives

market is the largest derivative market, with a notional amount of

outstanding of US $494 trillion.

End of Libor Creates Uncertainty for CME's Giant Eurodollar

Market

August 9, 2019 The BIS issues a

working paper calling for “unconventional monetary policy measures”

to “insulate the real economy from further deterioration in financial

conditions”.

(Un)conventional Policy and the Effective Lower

Bound

August 15, 2019 Blackrock

Inc., the world's most powerful investment fund (managing around $7 trillion in

stock and bond funds), issues a white paper titled Dealing with the next downturn.

Essentially, the

paper instructs the US Federal Reserve to inject liquidity directly into the

financial system to prevent “a dramatic downturn.”

Again, the

message is unequivocal: “An unprecedented response is needed when monetary

policy is exhausted and fiscal policy alone is not enough.

That

response will likely involve 'going direct': “finding ways to get central

bank money directly in the hands of public and private sector spenders”

while avoiding “hyperinflation. Examples include the Weimar Republic in

the 1920s as well as Argentina and Zimbabwe more recently.” - Fabio

Vighi

September 16, 2019 "Downturn

officially inaugurated by a sudden spike in the repo rates (from 2% to 10.5%).

'Repo' is shorthand for 'repurchase agreement', a contract where

investment funds lend money against collateral assets (normally Treasury

securities).

At the time of the exchange, financial operators (banks)

undertake to buy back the assets at a higher price, typically overnight.

In brief, repos are short-term collateralized loans.

They are

the main source of funding for traders in

the derivatives galaxy.

A lack of liquidity in the repo market can have a devastating domino

effect on all major financial sectors." - Fabio Vighi

September 19, 2019

Donald Trump signs Executive Order 13887, establishing a

National Influenza Vaccine Task Force whose aim is to develop a

“5-year national plan to promote the use of more agile and scalable

vaccine manufacturing technologies and to

accelerate development of

vaccines that protect against many or all influenza

virus.”

Understandably unwilling

to go to war with International Monetary Fund(IMF) and the

World Bank(WB) that controlled their debt,

crisis struck new democracies after WWII had to

accept IMF and the WB rules.

In the early eighties, IMF and the WB rules

got a great deal stricter.

The debt shock coincided precisely, and not

coincidentally, with a new era in relations, one that would make military

dictatorships largely unnecessary.

It was the

dawn of the era of "structural adjustment" -

dictatorship of debt.

Milton

Friedman's Chicago

School of Economics cracks

China open.

"Economic reforms" turn

China into the

sweatshop of the world.

"The Princelings", billionaires,

are children of Communist Party officials.

Although the IMF and the WB

have loaned money to 'undeveloped' countries the costs have been

staggering.

The IMF and the WB does not

make loans for altruistic purposes.

Collateral includes

infrastructure and

natural resources.

WB

and the IMF force countries to

privatize their

infrastructure to be eligible for debt relief as they did in the Asian

financial crisis.

How the IMF

helped create and worsen the Asian financial crisis

World Bank – IMF Guilty of Promoting Land Grabs, Increasing

Inequality

|

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to

discern pr☠paganda from

reality and that this has been done purposefully by an internati☣nal

c☣rp☣rate cartel through their agents who wish to foist a corrupt

version of reaλity on the human race. Religi☯us int☯lerance

☯ccurs when any group refuses to tolerate religi☯us practices,

religi☸us beliefs or persons due to their philosophical ideology. This

web site marks the founding of a system of philºsºphy nªmed The

Mŷsterŷ of the Lumière Infinie - a ra☨ional

gnos☨ic mys☨ery re☦igion based on reaso🐍 which

requires no leap of faith, accepts no tithes, has no supreme leader, no church

buildings and in which each and every individual is encouraged to develop a

pers∞nal relati∞n with Æ∞n and Sustainer through the

pursuit of the knowλedge of reaλity in the hope of curing the

spiritual c✡rrupti✡n that has enveloped the human spirit. The

tenets of The Mŷsterŷ of the Lumière Infinie are spelled out

in detail on this web site by the author. Vi☬lent acts against

individuals due to their religi☸us beliefs in America is considered a

"hate ¢rime."

This web site in no way c☬nd☬nes

vi☬lence. To the contrary the intent here is to reduce the violence that

is already occurring due to the internati☣nal c☣rp☣rate

cartels desire to c✡ntr✡l the human race. The internati☣nal

c☣rp☣rate cartel already controls the world central banking system,

c☸rp☸rate media w☸rldwide, the global indus✈rial

mili✈ary en✈er✈ainmen✈ complex and is responsible for

the coλλapse of moraλs, the eg● w●rship and the

destruction of gl☭bal ec☭systems. Civilization is based on

coöperation. Coöperation with bi☣hazards at the

point of a

gun.

American social mores and values have declined precipitously

over the last century as the internati☣nal c☣rp☣rate cartel

has garnered more and more power. This power rests in the ability to deceive

the p☠pulace in general through c✡rp✡rate media by

press☟ng em☠ti☠nal butt☠ns which have been

πreπrogrammed into the πoπulation through prior

c✡rp✡rate media psychological operations. The results have been

the destruction of the fami♙y and the destruction of s☠cial

structures that do not adhere to the corrupt internati☭nal elites vision

of a perfect world. Through distra¢tion and ¢oer¢ion the

direction of th✡ught of the bulk of the p☠pulati☠n has been

directed toward solutions proposed by the corrupt internati☭nal elite

that further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion and

☨hough☨s have been adapted, edited, corrected, redacted, combined,

added to, re-edited and re-corrected as nearly all opinion and

☨hough☨ has been throughout time but has been done so in the spirit

of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of criminal justice,

human rights, political,

politi¢al, e¢onomi¢, demo¢rati¢, s¢ientifi¢,

and so¢ial justi¢e iϩϩueϩ, etc. We believe this

constitutes a 'fair use' of any such copyrighted material as provided for in

section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section

107, the material on this site is distributed without profit to those who have

expressed a prior interest in receiving the included information for

rėsėarch and ėducational purposės. For more information

see: www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|