|

"Government cannot prevent nature from taking its

course."

David Rosenberg, chief North American economist at

Merrill

Lynch

"Hedge funds are now targeting each other.

Morgan Stanley and

Goldman Sachs, who made

obscene profits by shorting stocks in the past,

are vociferously against the practice now that their stocks are the ones being

destroyed." - Bruce Goodman

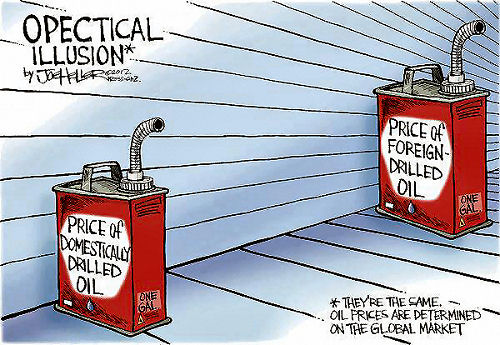

"Oil prices are largely

not determined by supply and

demand but the trading desks of large Wall Street firms." - Michael

Masters, hedge fund manager

"Hedge fund riches helped inflate the price of

everything from modern art to Manhattan real estate. Top managers raked in

billions of dollars a year, and managing a

fund became the running dream on Wall Street" - Louise Story

10/22/08

A hedge

fund is a private investment

fund.

Hedge funds are

not subject to any direct

regulation by the SEC, the

National Association of Securities Dealers (NASD), now the Financial

Industry Regulatory Authority (FINRA), or any other regulating commission.

Hedge funds may hold long or short assets, enter into

futures, swaps,

short selling schemes,

structured investment vehicles and

derivative contracts.

Structured Investment Vehicle

Some hedge funds focus

on other financial instruments including commodity futures, options, and

emerging market debt.

A security may be

an electronic entry in a software system

that is fungible - you can trade it for

an electronic entry in a different

software system.

As hedge funds typically lever debt to invest, the

positions they can take in the financial markets are larger than their assets

under management.

Only 17% of hedge fund managers see an economic

downturn as a bad news.

1974 Marc Rich & Co. AG founded by

commodity traders Marc

Rich and Pincus Green.

1994 After failing to take

control of the zinc market and losing $172 million, Rich is forced to sell his

majority share to Glencore International.

2005 ABC Radio reports

Glencore "accused of illegal dealings with rogue states: apartheid South

Africa, USSR, Iran, and Iraq under Saddam Hussein", and has a "history of

busting UN embargoes to profit from corrupt or despotic regimes".

CIA

claims Glencore paid $3,222,780 in illegal kickbacks to obtain oil in

the course of the UN oil-for-food programme for Iraq.

2013 Glencore merges with

Xstrata.

Glencore plc is an Anglo-Swiss multinational commodity

trading and mining company with headquarters in

Baar, Switzerland, its oil and gas

head office in London and its registered office in Saint Helier,

Jersey.

In 2015 Glencore plc ranked tenth in the Fortune

Global 500 list of the world's largest companies.

1983 Rich and partner Pincus Green are indicted on 65 criminal

counts; income tax evasion,

wire fraud,

racketeering, trading with Iran during

oil embargo.

Maxxam 1985 A Texas based corporation owned and

operated by Charles Hurwitz, a United Jewish Appeal-Federation official,

succeeds in a $900 million

hostile takeover

of Pacific Lumber, a incorporation with local ties stretching back to the

1850s.

Maxxam's hostile

takeover could not have taken place without the financing arranged through

the sale of junk bonds by

Michael Robert Milken.

Maxxam kept the Pacific

Lumber name, but tripled the rate of its logging operations threatening the

last redwood forests on earth.

Protests ensued (treesitters) and 10 years later the Headwaters

Forest exchange between the US government and Pacific Lumber was

enacted.

Maxxam owns some 210,000 acres in Humboldt County.

The

accelerated logging of Maxxim and others has polluted some 85% of the waters in

California's North Coast region, uprooted protected redwoods and damaged

private property.

Maxxam was given $480 million in taxpayer money for

some 7,500 acres of ancient redwoods - the Headwaters Forest. The "deal"

included a 50 year ban on logging within an additional 7,000 acres but allowed

Pacific Lumber to bypass many logging restrictions which including protections

for endangered species and limits on the rate of logging.

Officials

continue to permit logging corporations to avoid complying with environmental

regulations.

1986 Ivan Frederick Boesky, an arbitrageur,

has amassed over US$200 million betting on corporate takeovers and the $136

million in proceeds from the sale of The Beverly Hills Hotel, is on the

cover of Time

magazine.

Ivan F. Boesky & Co. was founded in

1975 with $700,000 (equivalent to $3.3 million in

2018) worth of startup money from his wife's family.

1987 A group of partners sue Boesky over what they claim are

misleading partnership documents.

The Securities and Exchange Commission

investigates him for making investments based on information received from

corporate officers.

Stock acquisitions were sometimes brazen, with

massive purchases occurring only a few days before a corporation announced a

takeover.

Although

insider trading of this kind was illegal, laws prohibiting it were rarely

enforced until Boesky was prosecuted.

Boesky received a prison sentence

of 3 1/2 years and is fined US$100 million.

In a 1991 divorce

settlement his wife

agrees to pay him $23 million and $180,000 a year for the rest of his natural

life.

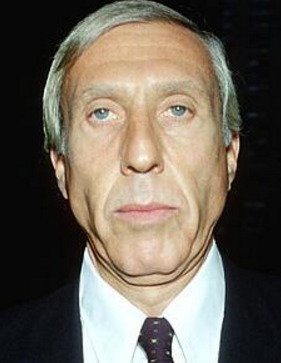

Michael

Robert Milken:

The "Junk Bond King", expanded the use of

high yield debt in corporate finance increasing mergers and acquisitions, which

in turn fueled the 1980s boom

in leveraged buyouts,

hostile

takeovers, and corporate raids which were responsible for moving untold

wealth out of middle American into the hands of men like

Charles

Hurwitz.

Milken was responsible for a

large swath of Northern

California clearcut pushing King Salmon to the brink of extinction through

habitat destruction.

1989 Milken indicted on 98 counts of

racketeering and

securities fraud.

Milken plead guilty to six felony counts of

securities fraud and

conspiracy, paid $600 million

in fines was sentenced to ten years in prison but only spent 22 months behind

bars.

Milken Settles S.E.C. Complaint for $47 Million

Junk bond king Michael Milken looms large in L.A. finance

industry

1990

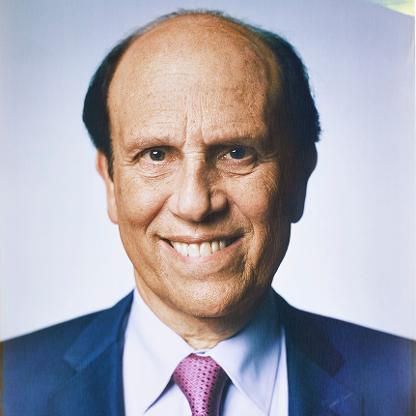

Peter Lynch reveals he has identified and invested in numerous tenbaggers as

the manager of the Fidelity Magellan Fund.

Magellan Fund grew from $18

million in assets when Lynch took it over to $19 billion.

Lynch

preferred stocks that had a price-to-earnings ratio below the industry mean and

less than its five-year average.

He looked for stocks where the

five-year growth rate in operating earnings per share (EPS) was high but below

50 percent as such earnings growth rates are unsustainable as companies growing

at this pace attract competition.

A tenbagger is Peter Lynch's term for

an investment that returns 10 times its initial purchase price.

Lynch

cited Wal-Mart as an example of a tenbagger.

Investors who purchased

Wal-Mart 10 years after it went public in 1970 still made 30 times their

money.

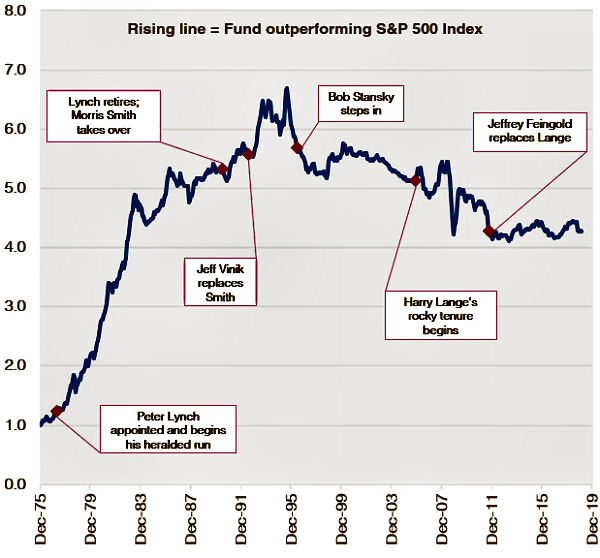

1998

During the first phase of

deregulation the financial industry had a near-meltdown triggered by a

collapse of Long-Term Capital

Management.

Although the

shareholders lost

their assets, the creditors are paid.

The loss of $4 billion in

five weeks is touted as the 'Dot-com

Bubble.'

The paper wealth of lower echelon

corporate management, members of the

middle class, in the form

of 'under water' stock

options, evaporated.

'Under water' stock

options, granted at a share price higher than the current

market share return

the wealth to controlling corporate interests.

"A consortium of banks

rescued Long-Term Capital Management, but it took 15 months, September 1998 to

January 2000, to negotiate the way out of trades tied to more than $1 trillion

in bets." - Richard Teitelbaum, Hugh Son

2000

Tiger Management fails after raising $6

billion.

2003 Aman Capital is

set up by top derivatives traders.

Leveraged trades in credit

derivatives resulted in an estimated loss of hundreds of millions of dollars.

Dissolved June 2005.

2004 Edward Lampert 'earns' $1.02

billion.

2005 Bailey Coates

Cromwell Fund leveraged trades chop 20% off a $1.3 billion portfolio in a

matter of months.

Dissolved June 20, 2005.

Marin Capital

attracts $1.7 billion in capital and puts it to 'work' using

credit arbitrage and convertible arbitrage

making a large bet on General

Motors.

General

Motors' bonds downgraded to junk, fund crushed.

Dissolved on June

16, 2005.

James Harris

Simmons 'earns' $1.6 billion.

T. Boone Pickens 'earns' $1.5

billion.

Kenneth C Griffin

'earns' $1.5 billion.

2006 Ospraie Management

LLC closed a $250 million hedge fund specializing in commodity trading.

The Ospraie Point Fund lost 29% in five months. Losses from bad

bets in commodities that fell sharply.

Dissolved June 08, 2006.

Edward Lampert 'earns'

$1.3 billion.

James Harris

Simons 'earns' $1.7 billion.

Amaranth Advisors, a

hedge fund manager, loses $6 billion in wrong-way bets on natural gas

derivatives in September.

Amaranth Advisors net asset value

declined by 65% to 70%.

Amaranth Advisors controlled 40% or more

of natural gas contracts in 2006 and in one month controlled 70%.

2007 Senate investigators

conclude that Amaranth Advisors trading actions drove up the price of

natural gas for the entire natural gas market.

Amaranth Advisors

agreed to pay $717,000 to settle SEC

charges of violating securities rules.

Bear Stearns hedge fund

Enhanced Leverage Fund and High-Grade Fund together borrows $20

billion to invest in sub-prime mortgage backed

bonds.

"Our liquidity and

balance sheet are strong." - Alan Schwartz, CEO of Bear Stearns 36

hours before seeking emergency funding

Investors are told in July 2007

that their investment of $1.5 billion is gone.

In a survey conducted by

Rothstein Kass 61% of hedge fund managers stated that a recission in America

was very likely in 2008.

66% of hedge

fund managers said a recission

would bring 'opportunities'.

Financier George Soros

funds population control.

Soros, like

Ted Turner, has five

children but worries that other people are having too many.

His

foundations include the Open Society Institute (OSI), which has a unit

that supports abortion.

1998 International

Women's Health Coalition after receiving generous grants from OSI publishes

a strategy booklet on how to spread abortion in poor nations.

Focusing

on legal change, it suggested using documents from recent international

conferences to promote abortion.

Training "health professionals in

basic abortion techniques."

Exploiting loopholes so that abortions can

be done "even in settings where laws are restrictive."

Changing

administrative practice so that, for example, paramedics can do early

abortions.

Using research on illegal and "unsafe" abortion to

campaign for

legalization. |

George Soros 'earns' $1

billion.

Stephen A. Cohen

'earns' $900 million.

Bruce

Kovner 'earns' $715 million.

Paul Tudor Jones II'earns' $690

million.

Tim Barakett

'earns' $675 million.

David

Tepper 'earns' $670 million.

Carl Icahn 'earns' $600

million.

Hedge fund manager John Paulson makes $3 billion shorting

financials in anticipation of

the American housing market collapse.

John Paulson is believed to have

made $428 million from September to February by short selling

Lloyds Banking Group Plc

and HBOS Plc.

Ray Lee Hunt:

September 8, 2007 Hunt signs a petroleum deal with the

Kurdistan Regional Government of Iraq.

Ray Lee Hunt spent most of the

Bush administration serving on the President's Foreign Intelligence Advisory

Board.

The Iraqi petroleum minister denounced the deal as illegal,

though there was no specific law against it, claiming it undermined the

country's negotiations to share profit between the

Kurds,

Sunni and

Shi'a.

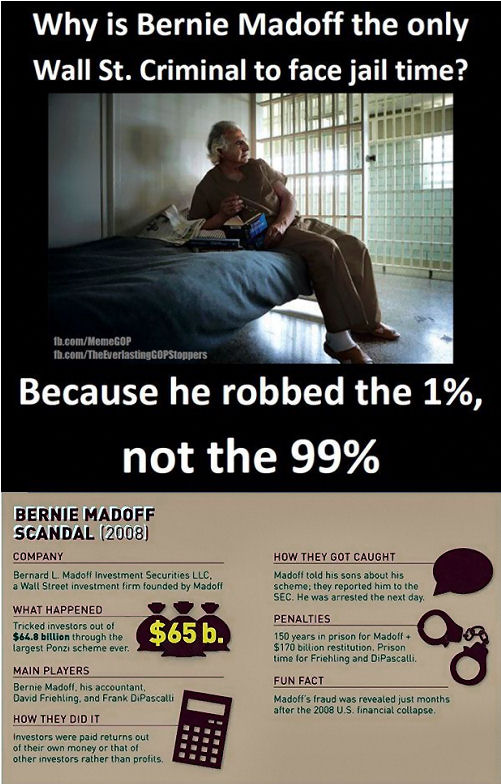

2009 Bernie Madoff is incarcerated and then hospitalized

within a year for "severe facial fractures, broken ribs, and a collapsed

lung".

CFO Frank DiPascali and five former colleagues were also

convicted.

$36 billion was invested: $18 billion to investors with $18

billion missing.

"Bernie was known for

generous

philanthropy to Jewish

causes.

Madoff was no Robin Hood, his philanthropic and

charity contributions

facilitated access to the wealthy who served on the

boards of the

recipient institutions proving he was

a super-rich 'intimate' of the

same elite class

The shock following Madoff's

confession he was 'running a

Ponzi scheme' drew as much anger for the money lost and the fall from the

moneyed class as for the

embarrassment of knowing that the world's biggest

exploiters and smartest swindlers on Wall Street, were completely 'taken.'

Madoff's fraudulent behavior was not the result of

personal moral failure.

It is

the product of a systemic imperial

economic culture.

The paper

economy, 'sophisticated financial

instruments' are all 'Ponzi

schemes,' as they are not based on producing and selling goods and

services.

They are financial bets on future financial paper growth

based on securing future buyers to pay off earlier cash ins." - James

Petras

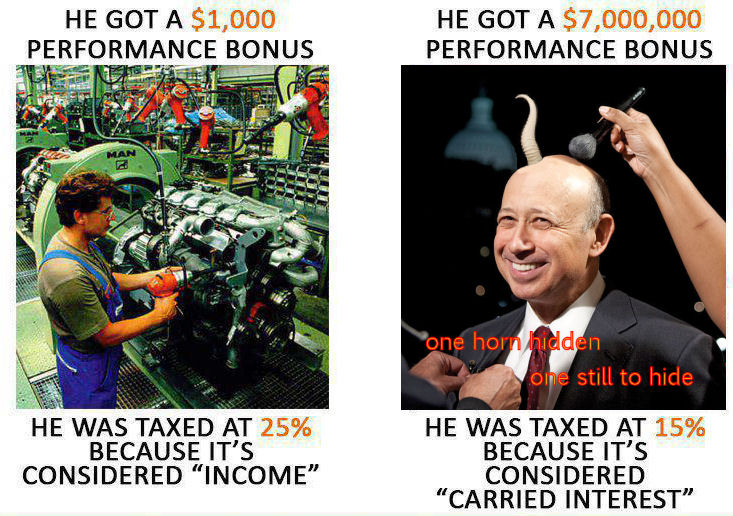

earned income

Hedge fund managers hold their assets one year and

one day magically converting short term assets into long term assets.

"Since 1960 each of the seven previous recoveries ended

with a greater percentage of women at work than when it began.

Working

women now earn a third of America's total household income, and by and large,

only those homes with a working wife have made real gains in their standard of

living over the last eight years.

Yet, over that same period, the

percentage of women employed outside the home has fallen to where it was 12

years ago.

Meanwhile, the median hourly pay of women 25 to 48 years of

age has fallen from $15.04 in 2004 to $14.84 last year.

This corrosive

pattern holds true, according to the federal statistics, for all American

women, regardless of education, race, ethnicity or marital or

familial status." - Tim Rutten

07/08

"Working mothers

work because their families need their paychecks.

Therefore, by

definition, families in which the wife is

not required to work are families feeling a little less crushed by the new

economy."- Renee Leask

"The real argument isn't that the top 1% pay

40% of federal income taxes.

Wage earners can be taxed up to 35%.

Capital-gains earners generally can be taxed as high as 15%.

Individuals whose wealth works by accruing wealth from investments are

rewarded by the government for being

wealthy enough not to have to work.

The rest are penalized for

showing up to work." - Brain T. Finney

Intercontinental Exchange (ICE)

"Goldman Sachs was one of

the founding partners of online commodities and

futures market Intercontinental

Exchange (ICE).

ICE has been a primary focus of recent congressional

investigations.

It was named in both the Senate Permanent

Subcommittee on Investigations, June 27, 2006 and the House Committee on

Energy & Commerce hearing.

Those investigations looked into the

unregulated trading in

energy

futures and concluded energy price climb to stratospheric heights has been

driven by the billions of dollars' worth of oil and natural gas futures

contracts being placed on the ICE, which is not regulated by the Commodities

Futures Trading Commission." - Ed Wallace

Richard Edward Rainwater:

Investment manager for the four Bass brothers from 1970 to

1986.

Bass Brothers:

Born into

an extremely wealthy family with an uncle, Sid Richardson worth $810 million,

Robert, Lee, Ed, and Sid Bass all attended Yale University.

Ed Bass is a

classmate and personal

friend of George

W. Bush, and the brothers, especially Lee Bass, helped

George W Bush financially

both before and throughout his political career.

Robert Rowling:

George Walker Bush campaign

Pioneer

|

|

|

This web site is not a commercial web site and

is presented for educational purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to

discern pr☠paganda

from Яeality and that this has been done purposefully by an

internati☣nal c☣rp☣rate

cartel through their agents who wish to foist a corrupt version of

reaλity on the human race. Religi☯us int☯lerance ☯ccurs

when any group refuses to tolerate religious practices, religi☸us beliefs

or persons due to their philosophical ideology. This web site marks the

founding of a system of philºsºphy nªmed The Truth of the Way of

the Lumière Infinie - a ra☨ional gnos☨ic mys☨ery

religion based on reaso🐍 which requires no leap of faith, accepts no

tithes, has no supreme leader, no church buildings and in which each and every

individual is encouraged to develop a pers∞nal relati∞n with

Æ∞n through the pursuit of the knowλedge of reaλity in

the hope of curing the spiritual c✡rrupti✡n that has enveloped

the human spirit. The tenets of The Mŷsterŷ of the Lumière

Infinie are spelled out in detail on this web site by the author. Vi☬lent

acts against individuals due to their religi☸us beliefs in America is

considered a "hate ¢rime."

This web site in no way

c☬nd☬nes vi☬lence. To the contrary the intent here is to

reduce the violence that is already occurring due to the internati☣nal

c☣rp☣rate cartels desire to c✡ntr✡l the human race.

The internati☣nal c☣rp☣rate cartel already controls the

w☸rld ec☸n☸mic system, c☸rp☸rate media

w☸rldwide, the global indus✈rial mili✈ary

en✈er✈ainmen✈ complex and is responsible for the collapse of

morals, the eg● w●rship and the destruction of gl☭bal

ec☭systems. Civilization is based on coöperation. Coöperation

with bi☣hazards at the point

of a gun.

American social mores and values have declined

precipitously over the last century as the internati☣nal

c☣rp☣rate cartel has garnered more and more power. This power rests

in the ability to deceive the p☠pulace in general through

c✡rp✡rate media by press☟ng em☠ti☠nal

butt☠ns which have been πreπrogrammed into the

πoπulation through prior c✡rp✡rate media psychological

operations. The results have been the destruction of the fami♙y and the

destruction of s☠cial structures that do not adhere to the corrupt

internati☭nal elites vision of a perfect world. Through distra¢tion

and coercion the dir⇼ction of th✡ught of the bulk of the

p☠pulati☠n has been direc⇶ed ⇶oward

s↺luti↻ns proposed by the corrupt internati☭nal elite that

further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Øpinion and

☨hough☨s have been adapted, edited, corrected, redacted, combined,

added to, re-edited and re-corrected as nearly all opinion and

☨hough☨ has been throughout time but has been done so in the spirit

of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, politi¢al, e¢onomi¢,

demo¢rati¢, s¢ientifi¢, and so¢ial justi¢e

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|