|

"When Larry Summers, Obama's chief economic

advisor, piously tells us that the administration's hands are tied because we

all must abide "by the rule of law,"

perhaps it's time to ask: What rule

and for whom?"

Tim Rutten March 18, 2009 LA Times

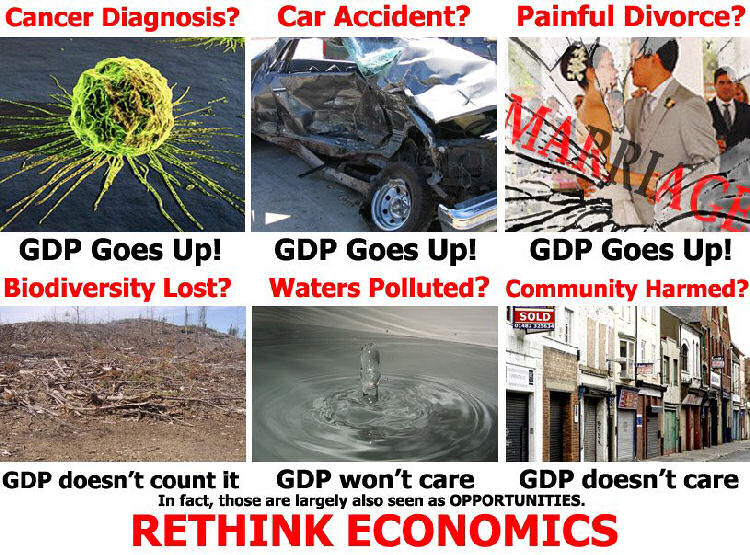

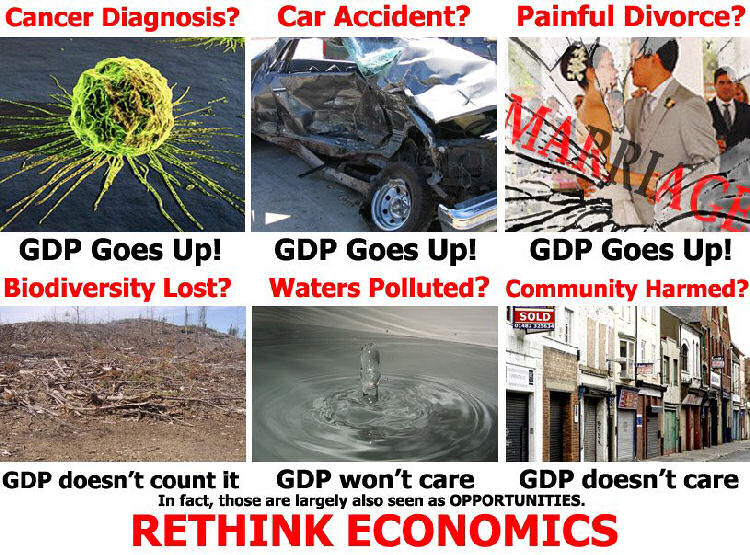

Economics is defined

as:domestic

management

theory and

management of economic

systems

"Karl Marx, whose

economic analyses are strikingly

prescient, saw how the credit economy is one way that

central banking systems

attempt to stretch out and soften

the boundary in which the private

accumulation of profit from production runs up against the waning

purchasing power of

consumers.

In a nation whose

governing parties and

increasingly wealthy corporate

elite can't restrain

themselves from devastating and

costly imperialist wars overseas while at the same time

impoverishing ever-growing numbers

of the struggling and poor at home." - Eric Brill 01/08

"Wherever

politics intrudes upon economic life, political success is readily attained by

saying what people like to hear rather than

what is demonstrably true. Instead

of safeguarding truth and honesty, the State then tends to become a

major source of insincerity and mendacity." – Hans F.

Sennholz

savings and loan debacle

The savings and loan debacle

began the regression of the American

republic into a "plutonomy" - a society in which

the largest economic gains flow to an

ever smaller portion of the population creating a decadent

social order that poorly rewards human

labor.

After the stockmarket

crash of 1929, Congress passed a series of laws designed to

restrict the ability of Wall Street to

manipulate markets.

1933 Glass-Steagall Act

Congress passes the

Glass-Steagall Act

separating commercial banking activity - savings and checking accounts, which

accepted wages as deposits

and issued small business loans and mortgages, from

investment banking activity, which

underwrote stocks and

corporate

bonds.

This is the governing economic principle for more than half a

century.

1971

Nixon

Shock

Richard Nixon consulted

Federal Reserve chairman Arthur Burns, incoming

Treasury Secretary John

Connally, and then Undersecretary for International Monetary Affairs and future

Fed Chairman Paul Volcker.

On the afternoon of Friday, August 13, 1971,

Nixon, on the advice of the

Connally, decided to break up Bretton Woods by announcing the

following actions on August 15:

Nixon directed Treasury Secretary

Connally to suspend, with certain exceptions, the convertibility of the dollar

into gold or other reserve assets, ordering the gold window to be closed

such that foreign governments could no

longer exchange their dollars for gold.

Nixon issued

Executive Order 11615 (pursuant to

the Economic Stabilization Act of 1970), imposing

a 90-day freeze on wages and

prices in order to counter

inflation.

This was the first time the U.S. government had enacted wage

and price controls since World War II.

An import surcharge of 10 percent was set to ensure that American

products would not be at a disadvantage because of the expected fluctuation in

exchange rates.

Speaking on television on Sunday, August 15, when

American financial markets were closed, Nixon said the following:

"We

must protect the position of the American dollar as a pillar of monetary

stability around the world.

In the past 7 years, there has been an average of one international

monetary crisis every year.

I have directed Secretary Connally to

suspend temporarily the convertibility of the dollar into gold or other reserve

assets, except in amounts and conditions determined to be in the interest of

monetary stability and in the best interests of the United States."

Simon Kuznets awarded the

Sveriges Riksbank Prize in

Economic Sciences in Memory of Alfred Nobel.

Kuznets curve

expresses the hypothesis as an economy develops, market forces first increase

and then decrease economic inequality.

The Kuznets curve appeared to be

consistent with experience at the time it was proposed.

According to

estimates put forward by Thomas Piketty

inequality has now returned to the levels of the late 19th century.

1973 Wassily Leontief awarded the

Sveriges Riksbank Prize fo input-output analysis which shows the process by

which inputs in one industry

produce outputs for consumption or for input into another industry.

The

matrix devised by Leontief is often used to

show the effect of a change in

production of a final good on the

demand for inputs.

Although the table is useful as a rough

approximation of the inputs required, economists know from mountains of

evidence that proportions are not fixed.

Specifically, when the cost of

one input rises, producers reduce their use of this input and substitute other

inputs whose prices have not risen.

If wage rates rise, for example,

producers can substitute capital

for labor and, by accepting wasted materials, can even substitute raw

materials for labor.

That the input-output table is inflexible means

that, if used literally to make predictions, it will necessarily give wrong

answers.

1977 George Herbert Walker Bush hired

by First International.

1978 First International fails and requires a $3.5

billion federal bailout.

Summary

Of The International Banking Act Of 1978

August

1979 Paul Adolph Volcker attempts to reign in the

money supply, and

inflation, by

raising interest rates to

stratospheric heights.

Most savings and loans fixed rate assets rate

of return are considerably below the prevailing rate of Federal Reserve

funds.

Savings and loans are paying, assume 12%, for loan capital but

their return on previous released capital is only 6%.

This policy

basically obliterates the Savings and Loan industry.

"The local

manufacturing sector never came back after the calamitous decline produced by

the Paul Volcker recession of 1979-1983, when

interest rates were deliberately raised

to over 20% to kill off family businesses so that global corporations could

step in and take over." - Richard C. Cook

December 12,

1980

Federal Reserve chairman Paul Adolph Volcker

BB /

CFR /TC raises the prime loan rate to

21.5%.

Deregulation

legislation is proposed to address the low rate of return of an investment

portfolio full of long-term, low fixed-rate assets.

Savings and

loans are given additional investment opportunities and adjustable rate

mortgages are allowed.

Wall

Street now sees the savings and loan industry as a "cash cow" to be "levered"

accordingly.

"I was working in the Carter

White House in

1979-80.

Paul Volcker,

a Rockefeller protégé,

suddenly raised interest

rates to fight inflation the bankers caused by the

OPEC oil price deals creating

a recession.

Through the "Reagan

Revolution" regulatory controls over bank loans were lifted allowing banks

to use fractional

reserves for consumer loans.

Volcker's

recession shattered American manufacturing and hastened the flight of jobs

abroad.

Under the "Reagan

Doctrine," the US embarked on a

mission of world conquest,

attacking one small

nation at a time, starting with

Nicaragua.

Global capitalism was on the

march, with the US armed forces its

own private police force." -

Richard C. Cook

Nancy Teeters, the lone dissenter

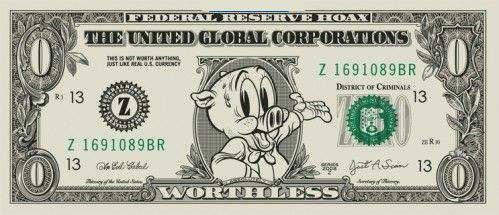

"People

think the Federal Reserve central

bank is US government

institution.

It is not a

government institution.

It is

a private credit monopoly of

those who prey upon the

people of the US for the benefit of themselves and their foreign customers;

foreign and domestic speculators and swindlers; and rich and predatory money

lenders.

Twelve private credit monopolies were deceitfully foisted upon

this country by bankers who came here

from Europe and who repaid us for our hospitality

by undermining our American institutions." -

Louis T. McFadden, House

Banking Committee Congressional Record, pg 1295 & 1296, June 10,

1932

1982 Gain-St Germain Depository Institutions Act

deregulation legislation

expands acceptable savings and loans investments by permitting savings and

loans to make short term consumer loans, issue

credit cards, and make

commercial real estate loans.

This was the method of stoking commerce after dumping water on the

entire economy by increasing the prime loan rate to 21.5% on December 12,

1980.

Financial

engineers claim broader investment opportunities will allow savings and loans

to better diversify their portfolios enabling financial stabilty.

Beginning from a situation where

liabilities exceed assets, financial managers cannot overcome shortages by

pursuing a conservative investment course.

This provided

the means for increased risk

taking while ignoring the need for future capital investments by lowering

capital requirements.

With revised accounting rules to artificially

boost reported fractional

reserve equity savings and loans began to look for new investment

opportunities.

Once the interstate lending rules had been suspended the

preferred method became raising rates paid on certificates of deposits - CDs -

to garner more deposits and to

make new investments promising still higher returns.

In the past

depositors had no reason to send funds to savings and loans halfway across

America but rapidly advancing computer technology - the overnight transfer -

changed that by making possible a nationwide market in deposits while the

higher rates made it worth the trouble.

The Federal Deposit Insurance Corporation

(FDIC) preserves and promotes public

confidence in the US financial system by insuring

deposits in banks and

thrift institutions for at least

$250,000.

Are All Bank Accounts Insured by the FDIC?

Federal

deposit insurance put insolvent

institutions in a position to abuse the new market as federally insured

depositors are unconcerned about the health of the institutions in which they

placed their money.

Undercapitalized savings and loans assured

themselves a continuous inflow of capital by simply offering to pay

higher interest rates than

competitors.

Healthy savings and loans are asked to pay increasing

deposit insurance premiums to protect depositors in failed institutions and

consequently gain little or no cost advantage from the fact they are well

capitalized.

Funds flow from stronger banks and savings and loans to the

weakest banks.

1986

The movement to use the

Federal Reserve Board to

kill Glass-Steagall

begins.

Federal Reserve

Board reinterprets existing law to allow commercial banks to derive a

minuscule 5% of their revenues from

investment banking

activities.

1989 Alan Greenspan bumps

investment banking

activities up to 10%.

1996 Through creeping

incrementalism Alan Greenspan kills Glass-Steagall when he ups the limit

investment banking activities to 25%.

July 1999 Larry

Summers is appointed Treasury Secretary when

Robert Edward Rubin leaves to become

Vice Chairman of Citigroup.

Larry Summers is

directly responsible for the financial institution meltdown.

As

William Jefferson Clinton' Treasury Secretary from July 1999 - January 2001 he

shaped the financial deregulation that unleashed the crisis.

"Scores of banks failed in the

Great Depression as a

result of unsound banking practices. Their failure deepened the crisis. Glass-Steagall was

intended to protect our financial system by

insulating commercial banking from

risk. It was one of several stabilizers designed to keep a similar tragedy

from recurring. Now Congress is about to repeal that economic stabilizer

without putting any comparable safeguard in its place." -

Paul Wellstone

"If we got a return to positive growth - an economy

growing at 1% would be an economy with rising unemployment. I don't think we

can hold out the prospect we'll stabilize at the current level." - Larry

Summers 4/9/09

November 12,

1999

Gramm-Leach-Bliley Act officially repeals the Glass-Steagall Act of

1933.

The merger

of commercial and investment banking once again allows

investment bankers to use FDIC

insured personal commercial

deposits to purchase "financial

instruments" from hedge

funds.

2000

Short sellers attempt to profit

from an predicted decline in the

fungible asset

valuation of the value of

a fungible

financial instrument.

Short sellers take loans on

fungible financial

instruments - bonds,

marketable securities,

futures contracts,

securitized loans,

collateralized debt

obligations.

The

short seller is betting on being

able to purchase identical

fungible security

instruments at a lower price shortly before the loan comes due.

Profit

comes when the fungible financial instrument declines in value.

Larry

Summers backs the Commodity

Futures Modernization Act.

Larry Summers directly profits from

the deregulation by vigorously advising DE Shaw and Taconic Capital

Advisors in hedging strategies.

Larry Summers circle of friends

include the hedge fund managers Nancy Zimmerman, Laurence D. Fink, Kenneth D.

Brody, Frank P. Brosens, H. Rodgin Cohen, Orin S. Kramer, Ralph L. Schlosstein

and Eric M. Mindich.

Larry Summers

later has Harvard purchase

interest rate swaps while president of Harvard that end up costing

Harvard over $1

billion.

"The SEC's best estimate is that there are now approximately

8,800 hedge funds, with approximately $1.2 trillion of assets.

If this

estimate is accurate, it implies a remarkable growth in

hedge fund assets of almost

3,000% in the last 16 years.

Hedge funds are becoming more active in

such varied activities as the market for

corporate control, private

lending, and the trading of crude

petroleum.

Hedge funds account for about 30% of all US equity

trading volume.

Investment strategies or operations of

hedge fund include their use of

derivatives trading, leverage, and short selling.

The number of

enforcement cases against hedge

fund advisers has grown from just four in 2001 to more than 90 since then.

These cases involve

hedge fund managers who

misappropriated funds assets;

engaged in insider trading;

misrepresented portfolio

performance; falsified their

experience and credentials; and lied

about past returns." - Securities and Exchange

Commission Chairman Christopher Cox, July 25, 2006

"The mistake

most people make in looking at the financial crisis is thinking of it in

terms of money, a habit that might lead you to look at the unfolding mess as a

huge bonus-killing downer.

Looked at it in

purely Machiavellian terms,

what you see is a colossal power grab that threatens to turn the US government

into a kind of giant

Enron - a huge, impenetrable black box

filled with self-dealing insiders." - Matt Taibbi

speech delivered by Mr Jaime Caruana,

General

Manager of the BIS

"Tight residential real estate markets and low

mortgage rates fueled a five-year

property boom as the number of US households paying more than half their

incomes for housing jumped from 13.8 million in 2001 to 17.9 million in 2007."

- Brian Louis

"Between 1999 and 2004, more than half the states,

both red (North Carolina, 1999; South Carolina, 2004) and blue (California,

2001; New York, 2003), passed anti-predatory-lending laws.

Georgia lite

a firestorm in 2002 when it sought to hold Wall Street gamblers of

mortgage-backed securities responsible for mortgages that were fraudulently

conceived.

Beginning in 2004 Michigan and forty-nine other states

battled the US Comptroller of the Currency and the banking industry (and

The Wall Street Journal editorial page) for

the right to examine the books of

Wachovia's mortgage unit, a fight the

Supreme Court decided in

Wachovia's favor in 2007 - about a year before it cratered." - Dean

Starkman

1863 National Bank Act establishes the

Office of the Comptroller of the Currency as part of the Treasury Department and a

system of nationally chartered banks.

The Office of the

Comptroller of the Currency examines the books of national banks to make

sure they are balanced.

"Several years ago, state attorneys general

and others involved in consumer protection began to notice a marked increase in

a range of predatory

lending practices by mortgage lenders.

In 2003 the OCC invoked a

clause from the 1863 National Bank Act to issue formal opinions preempting

all state predatory lending laws, thereby rendering them inoperative.

The OCC also promulgated new rules that prevented states from

enforcing any of their own consumer protection laws against national banks.

The US government's actions were so egregious and so unprecedented that

all 50 state attorneys general, and all 50 state banking superintendents,

actively fought the new rules.

But the unanimous opposition of the 50

states did not deter, or even slow, George Walker Bush in his goal of

protecting the banks.

In fact, when my office opened an investigation

of possible discrimination in mortgage lending by a number of banks, the OCC

filed a federal lawsuit to stop the investigation." - Elliot Spitzer, Washington Post, February 13,

2008

On the afternoon of February

13 federal agents of the Office of the Comptroller of the Currency staked out

Elliot Spitzer's hotel in Washington.

Elliot Spitizer's

dalliance with a

prostitute became headline news March 10.

Corporate news never questioned the

actions of the federal agents.

"One is struck by the similarities with the

Savings and Loan scandal which was allowed to continue through the 1980s, long

after it became apparent that deliberate bankruptcy was being used

by unscrupulous profiteers.

The long drawn-out housing bubble of

the current George Walker

Bush decade, and particularly the

derivative bubble that was

floated upon it, allowed the Bush administration to help offset the

trillion-dollar-plus cost of its Iraq

misadventure." - Peter Dale Scott

investment bank meltdown

"The injunction of Jesus to love others as

ourselves is an endorsement of self-interest." -

Brian Griffiths, Goldman Sachs PR

"We see TARP as an insurance policy. No matter how

bad it gets, we're going to be one of the remaining banks."- John C. Hope III,

Whitney National Bank chairman 1977 AL Williams establishes its base by mass-marketing

the concept of "Buy Term and Invest the Difference."

AL

Williams suggests its middle-income client base purchase sufficient

protection with term life insurance to systematically save and invest in

separate investment vehicles, such as mutual fund Individual Retirement

Accounts.

AL Williams is initially established as a

privately held general agency, at first selling term life insurance policies

underwritten by Financial

Assurance.

Facing a capital crisis Kuhn & Loeb merges with Lehman Brothers, to

form Lehman Brothers, Kuhn, Loeb Inc.

Internationally known as

Kuhn Loeb Lehman Brothers Inc.

1980 AL

Williams enters into a

contract with Boston-based Massachusetts Indemnity and Life

Insurance (MILICO), a larger

underwriter of life

insurance, whose parent is PennCorp Financial Services, Santa

Monica.

1981 John H.

Gutfreund orchestrates the sale of Salomon Brothers to the commodity

trading firm Phibro.

Salomon is noted in the

bond market for selling

mortgage-backed securities, a hitherto obscure species of financial instrument

first created by Ginnie

Mae.

Salomon begins purchasing home mortgages from thrifts and

packaging them into mortgage-backed

securities then sold to local and international investors.

First American National Corporation is

established as a holding company for First American Life Insurance

(rebranded AL Williams Life Insurance) and First American National

Securities (rebranded PFS Investments).

Shearson is

acquired by American Express and operated as a subsidiary.

1982 First American National Corporation, rebranded

The AL Williams Corporation, begins underwriting public stock

offerings.

1983

The AL Williams Corporation is listed on the NASDAQ exchange under ALWC.

American Can and PennCorp Financial Services

merge.

1984 Shearson

merges with Lehman Brothers, Kuhn, Loeb Inc. evolving into Shearson

Lehman.

Original Phibro CEO David Tendler is replaced by John

H. Gutfreund.

"The move puts Mr. Gutfreund, who is 54 years old, at the

helm of a two- pronged company with $42 billion in assets, $30 billion in

revenue, $617 million in annual profits, 6,700 employees and 25,000

shareholders. It has the capability of trading virtually anything, from wheat

to mortgage-backed securities." - Michael Blumstein, After the coup at

Phibro-Salomon 8/12/84

1986 Sanford Weill,

scion David-Weill family, purchases Commercial Credit from Control

Data for $7 million.

Lazard Freres - the biggest investment bank in

France - is owned by Lazard and

David-Weill families - old Genoese banking scions.

1987 86-year-old American Can announces a name change

to Primerica Corporation.

Primerica Corporation completes

a hostile takeover of Smith

Barney.

Sanford Weill acquires Gulf Insurance.

1988 Commercial Credit acquires Primerica

Corporation for $1.54 billion.

Shearson Lehman acquires EF

Hutton to be Shearson Lehman Hutton.

1989 Sanford Weill acquires retail brokerage

Drexel Burnham

Lambert.

Eight Charged in $50-Million Car Loan Fraud

1991 Primerica Corporation changes the name of AL

Williams to Primerica Financial Services.

US taxpayers,

already billed over $500 billion dollars for the S&L looting, are charged

another $70 billion to bail out the depleted FDIC.

US

taxpayers foot the bill for a secret 2 1/2-year rescue of

Citibank, close to collapse

after the Latin American debt crunch.

The Saving of Citibank

John S. Reed, chairman and CEO

of Citicorp, engineered a radical change in a major operating group,

built a lucrative new business from scratch, and played a high-visibility role

in the pivotal issue of Third World debt.

Citicorp Faces the World: An Interview with John

Reed

(The Washington

Post article above implies that the problem was domestic when clearly

the problem revloved around Third World debt.)

1993 Primerica acquires Travelers Insurance and

adopts the name Travelers.

Sanford Weill purchases Shearson

Lehman Hutton from American Express for $1.2 billion.

Shearson Lehman Hutton acquires Colorado-based lender, Aurora

Loan Services, an Alt-A lender.

1994 Sanford

Weill spins Lehman Brothers out of American Express.

The

CEO is

Richard Severin Fuld

Jr.

1995

Travelers becomes The Travelers Group.

1996 The Travelers Group purchases the property and

casualty business of Atena.

1997

Timeline of the Asian financial crisis

1998 Citicorp and Travelers merge and form the

behemoth Citigroup.

Travelers aquires Salomon and

merges it with Smith Barney creating Salomon Smith

Barney.

Citibank schemed with firm to hide its woes: Ex-Dewey

partner

2000 Shearson Lehman Hutton

purchases West Coast subprime

mortgage lender BNC Mortgage LLC.

BNC Mortgage LLC

quickly becomes a force in the subprime market.

September 11, 2001 Salomon Smith Barney is by far the

largest tenant in 7 World Trade

Center, occupying 1,202,900 sq ft (111,750 m2) (64% of the building) which

included floors 28–45.

Shearson Lehman Hutton occupies

three floors of World Trade

Center where one employee dies.

2002

Citigroup spins off Travelers Property and Casualty.

2003 Shearson Lehman Hutton makes $18.2 billion in

loans and ranked third in lending.

2004

Shearson Lehman Hutton makes over $40 billion.

Shearson

Lehman Hutton has morphed into a real estate hedge fund disguised as an

investment bank.

2005 Goldman Sachs receives

approximately $1.6

billion in taxpayer subsidies (Liberty Bonds) from New York City and state

taxpayers to finance a new headquarters near the World Financial Center in

Lower Manhattan.

2006

Aurora and BNC are lending almost $50 billion per

month.

Goldman Sachs changes its corporate structure into a bank

holding company.

Employees earn an average of $622,000 on a profit of

$9.4 billion.

Much of the commercial paper wealth is made on

takeovers and leveraged

buyouts.

Goldman Sachs employees:

George Herbert Walker Bush

(Lehman);

Robert

Zoellick (World Bank BB CFR

TC);

Henry Paulson (US Treasury Secretary);

Robert Rubin* (US Treasury Secretary,

Chairman Citigroup);

John Thain ( Merrill Lynch, Chairman NYSE);

Henry H.

Fowler, (US Treasury Secretary);

Edward Lampert (hedge fund manager);

Michael Cohrs (Global Banking at Deutsche Bank);

Mark Carney (Bank of

Canada);

Robert Steel (CEO of Wachovia);

Ed Liddy (CEO of AIG);

Neel Kashkari;

Gary Gensler (Commodity Futures Trading

Commission);

Stephen

Friedman (Chairman Intelligence Oversight Board,

Memorial Sloan-Kettering, Aspen

Institute, CFR, Brookings

Institution, Federal Reserve Bank of

New York.

Barack Obama

receives $981,000 for his

campaign from Goldman

Sachs.

2007 4th quarter Citigroup posts a

$10 billion loss, 21,200 Citigroup

employees are laid off.

Citigroup's single largest shareholder becomes Abu Dhabi Investment

Authority, the investment arm of Abu Dhabi government, with a $7.5 billion

injection of capital in late 2007 in exchange for a 4.9% stake which pays a

$1.7 billion a year dividend.

The second largest Citigroup shareholder,

with a 3.6% stake, is now Kingdom Holding incorporation owned by Prince

Al-Waleed bin Talal of Saudi

Arabia.

$6.88 billion of prefered stock is sold to an investment

fund controlled by the government of Singapore.

March through

September

2008

Five largest

investment bankers go bankrupt.

March

2008 Lehman Brothers assets of $680 billion are supported by

$22.5 billion of firm capital.

From an equity position, its risky

commercial real estate holdings are three times greater than capital.

In such a

highly leveraged structure, a 3 to 5% decline in real estate values wipes

out all capital.

Federal

Reserve sells Bear

Stearns at a discount to JP Morgan Chase for ten dollars per

share, far below the previous 52-week high of $133.20 per share.

June 2008 Merrill Lynch seizes $850

million worth of the underlying collateral from Bear Stearns but only

recoups $100 million in auction.

Merrill Lynch is given to Bank of America for $50 billion or

$29 per share.

The market valuation of Merrill Lynch was $100 billion

one year earlier.

During the final quarter of 2008 Merrill Lynch

loses $15.3 billion.

August 2008 Morgan Stanley is contracted

by the Treasury Department to

advise the government on potential rescue strategies for Fannie Mae and Freddie Mac.

September 21, 2008 Federal Reserve allows Morgan

Stanley to change its status from

investment bank to bank

holding company in order to survive.

November 23,

2008 Fed and Treasury announce a rescue package for

Citigroup to provide insurance against large losses on bundled

securities of $306 billion backed by residential and commercial real

estate.

Citigroup agrees to absorb the first $29 billion in

losses on the securities and derivatives; the Fed agrees to

cover 90% of losses exceeding that figure.

Citigroup

spends $1.77 million on lobbying

fees in the fourth quarter.

"Citigroup, like many others,

had sought to insure itself against losses with a variety of transactions,

including the purchase of insurance, only to learn that the losses were

overwhelming those who had promised to pay.

Insurance on the assets was

issued both by the bond insurers and by others that wrote what were known as

credit default swaps,

which amounted to insurance but were not regulated in the same way.

Those who wrote large amounts of such insurance are now in trouble,

either negotiating to pay claims for less than promised or, in the case of the

AIG, still in business only because of a government bailout.

The

AIG officials responsible for writing the swaps told investors they

would never suffer any losses." - Floyd Norris, November 24,

2008

"Sovereign wealth funds operated by

China, Singapore, Abu Dhabi,

and other countries have taken large equity stakes in Citigroup,

Merrill Lynch, Morgan Stanley, and other firms, including leading

European financial institutions." - Mark Jickling

"With Long-Term Capital Management

bailout as a precedent, creditors saw loans to

unsound financial institutions would

be made good by the Fed - as long as the collapse of those

institutions threatened

the global credit system.

Bolstered by this sense

of security, bad loans mushroomed.

The major creditors of the fund

included Bear Stearns, Merrill Lynch and Lehman Brothers,

all of which went on to lend and invest recklessly.

The ad hoc aspect

of the bailout created a precedent for what has come to be called "regulation

by deal" - now the government's modus operandi." - Tyler Cowen, December 26,

2008

"When the "credit crunch" began and Washington

began the rush to solve the problem with taxpayer cash, no accounting of this

derivative nightmare was ever

brought to bear.

In all the deliberations and press releases there was

not a single mention of the fact that the primary cause of the bank collapse

was due to these

'time

bombs'." - Andrew Hughes 1/27/09

April 2, 2009 Financial Accounting Standards Board relaxes the

"mark-to-market" rule.

Financial institutions are given the go ahead to value their derivative

assets in a "mark-to-model" manner - use

creative accounting methods to

value their toxic debt at 'projected market

value'.

"The announcement April 2, 2009 by the Financial Accounting

Standards Board (FASB) weakening "mark-to-market" accounting

rules allowing banks to value their

toxic debt at inflated

prices. This is a green light to continue the same methods of fraud and double

bookkeeping that triggered the breakdown of the financial system in the first

place." - Tom Eley

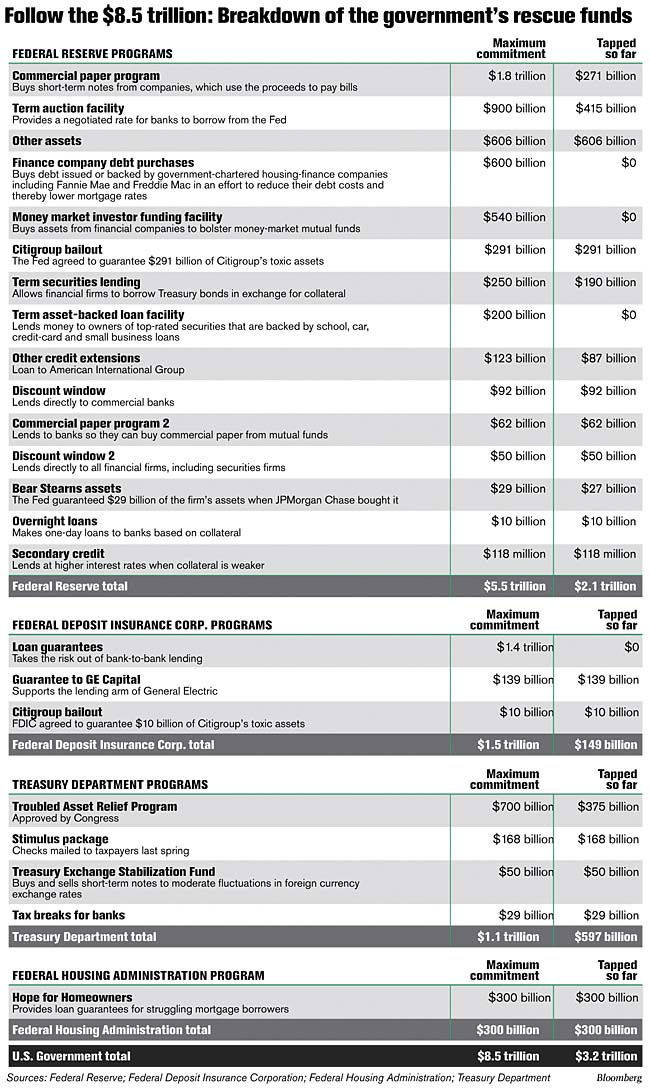

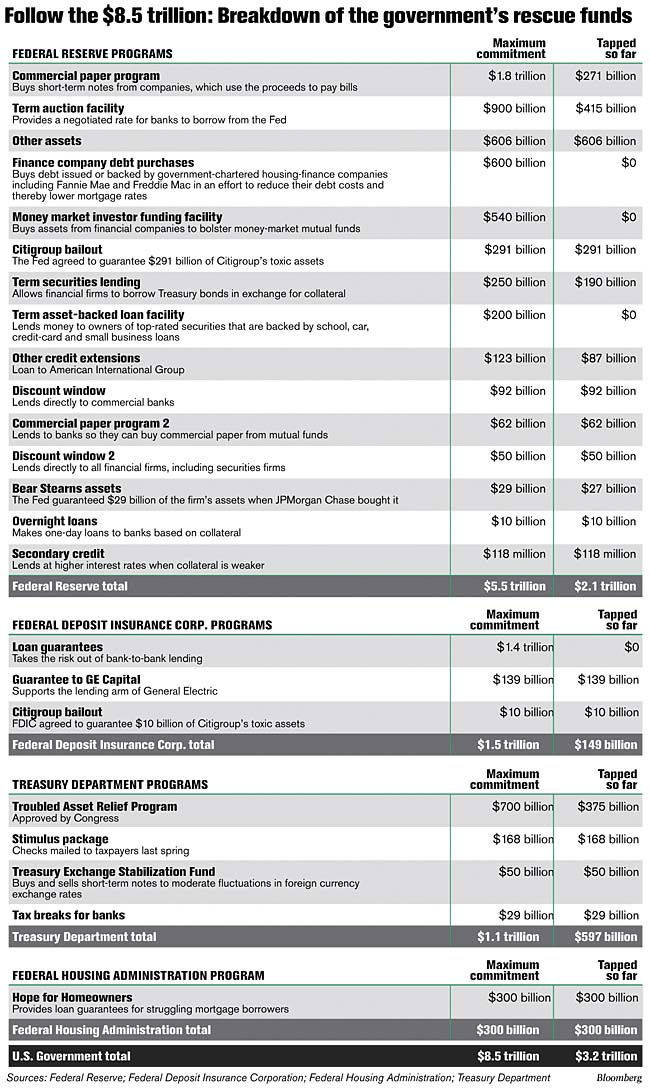

"US

taxpayers may be on the hook for as much as $23.7 trillion to bolster the

economy and bailout financial companies." - Neil Barofsky, special inspector

general for the Troubled Asset Relief Program (TARP), July,

2009

1995 Bill Gates and his father accompany Buffett and his wife

on a trip to China.

Gates, Sr. told Barron's that "we made a point of visiting a

family-planning center at a small village on the Yangtze River."

Max

Schulz of the Competitive Enterprise Institute criticized Buffett and

other members of what he called the "Billionaire Brigade" for buying into "the

phony crisis of overpopulation."

Schulz contends

problems in high-density population

areas "stem from failed socialist

policies, not from too many people." |

May 18, 2009 A top-secret meeting of the world's richest

people to discuss the global financial crisis is held in New York.

The

mysterious meeting held in the President's Room at Rockefeller University in

New York was called by Warren Buffett, CEO of Berkshire-Hathaway;

Bill Gates, co founder of Microsoft;

and David Rockefeller Jr.,

chairman of Rockefeller

Financial Services.

Attendees included Oprah Winfrey,

George Soros, Ted Turner, and

Michael Bloomberg, among

others.

In their letter of

invitation they note the worldwide recession and the urgent need to

plan for the future.

Each

attendee delivered a presentation on how they saw the future global economic

climate, the future priorities for

philanthropy, and what they felt the elite group should do.

They're called the Good Club - and they want to save the

world

November 25, 2008 to July 8, 2009

Financial institutions

issue $274 billion in debt under the Temporary Liquidity Guarantee

Program.

General Motors

Financial Services auto and home lender which recieved $13.5 billion

from US taxpayers in exchange for corporate debt in the form of junk

bonds becomes a bank to qualify for

Temporary Liquidity Guarantee

Program.

To insure $10 million of General Motors Acceptance

Corporation junk bonds

annually with a five-year

credit default swap contract it costs $895,000.

To insure the entire

$13.5 billion in General Motors Acceptance Corporation junk bonds

annually will cost over $1.2 billion annually.

Is Bank Debt a Security?

GMAC fined £2.8m for 'mistreating' mortgage

customers

2016 Phibro acquired by

Energy Arbitrage Partners.

BlackRock $1.9 Billion Credit Hedge Fund Suffers Worst

January

|

|

|

This web site is not a commercial web site and

is presented for educational

purposes only.

This website defines a

new perspective with which to en❡a❡e Яeality to which its

author adheres. The author feels that the faλsification of reaλity

outside personal experience has forged a populace unable to discern

pr☠paganda from reality and that this has been done purposefully by an

internati☣nal c☣rp☣rate cartel through their agents who wish

to foist a corrupt version of reaλity on the human race. Religi☯us

int☯lerance ☯ccurs when any group refuses to tolerate religious

practices, religi☸us beliefs or persons due to their religi⚛us

ide⚛l⚛gy. This web site marks the founding of a system of

philºsºphy nªmed The Truth of the Way of the Lumière

Infinie - a ra☨ional gnos☨ic mys☨ery re☦igion based on

reaso🐍 which requires no leap of faith, accepts no tithes, has no

supreme leader, no church buildings and in which each and every individual is

encouraged to develop a pers∞nal relati∞n with the Æon

through the pursuit of the knowλedge of reaλity in the hope of curing

the spiritual c✡rrupti✡n that has enveloped the human spirit. The

tenets of The Mŷsterŷ of the Lumière Infinie are spelled out

in detail on this web site by the author. Vi☬lent acts against

individuals due to their religi☸us beliefs in America is considered a

"hate ¢rime."

This web site in no way c☬nd☬nes

vi☬lence. To the contrary the intent here is to reduce the violence that

is already occurring due to the internati☣nal c☣rp☣rate

cartels desire to c✡ntr✡l the human race. The internati☣nal

c☣rp☣rate cartel already controls the w☸rld

ec☸n☸mic system, c☸rp☸rate media w☸rldwide, the

global indus✈rial mili✈ary en✈er✈ainmen✈ complex

and is responsible for the collapse of morals, the eg● w●rship and

the destruction of gl☭bal ec☭systems. Civilization is based on

coöperation. Coöperation with bi☣hazards of a

gun.

American social mores and values have declined precipitously over

the last century as the corrupt international cartel has garnered more and more

power. This power rests in the ability to deceive the p☠pulace in general

through c✡rp✡rate media by pressing emotional buttons which have

been πreπrogrammed into the πoπulation through prior

c☢rp☢rate media psych☢l☢gical ☢perati☢ns.

The results have been the destruction of the family and the destruction of

s☠cial structures that do not adhere to the corrupt internati☭nal

elites vision of a perfect world. Through distra¢tion and

¢oer¢ion the dir⇼ction of th✡ught of the bulk of the

p☠pulati☠n has been direc⇶ed ⇶oward

s↺luti↻ns proposed by the corrupt internati☭nal elite that

further con$olidate$ their p☣wer and which further their purposes.

All views and opinions presented on this web site are the views and

opinions of individual human men and women that, through their writings, showed

the capacity for intelligent, reasonable, rational, insightful and unpopular

☨hough☨. All factual information presented on this web site is

believed to be true and accurate and is presented as originally presented in

print media which may or may not have originally presented the facts

truthfully. Opinion and ☨hough☨s have been adapted, edited,

corrected, redacted, combined, added to, re-edited and re-corrected as nearly

all opinion and ☨hough☨ has been throughout time but has been done

so in the spirit of the original writer with the intent of making his or her

☨hough☨s and opinions clearer and relevant to the reader in the

present time.

Fair Use Notice

This site may contain

copyrighted material the use of which has not always been specifically

authorized by the copyright owner. We are making such material available in our

efforts to advance understanding of ¢riminal justi¢e, human

rightϩ, political, e¢onomi¢, demo¢rati¢,

s¢ientifi¢, and social justice

iϩϩueϩ, etc. We believe this constitutes a 'fair use' of any

such copyrighted material as provided for in section 107 of the US Copyright

Law. In accordance with Title 17 U.S.C. Section 107, the material on this site

is distributed without profit to those who have expressed a prior interest in

receiving the included information for rėsėarch and ėducational

purposės. For more information see:

www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted

material from this site for purposes of your own that go beyond 'fair use', you

must obtain permission from the copyright owner. |

Copyright

© Lawrence Turner Copyright

© Lawrence Turner

All Rights Reserved

|